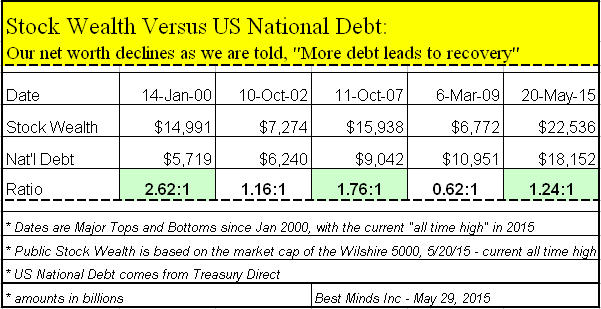

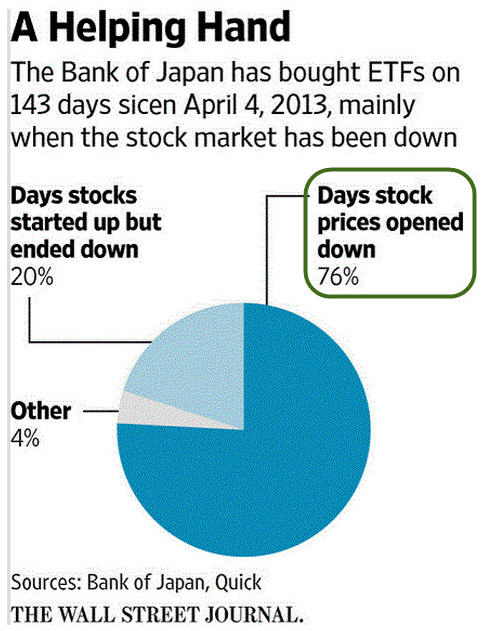

Over the last 7 years we have watched the largest expansion of debt and the powers of central banks ever on record. Not a month goes by that I do not ponder how we could have surrendered so much authority to these entities.

After the Great Recession in 2008 one would have thought that we would have learned something about pouring trillions of cheap debt into highly leveraged financial deals as the “rescue” from the most recent financial collapse.

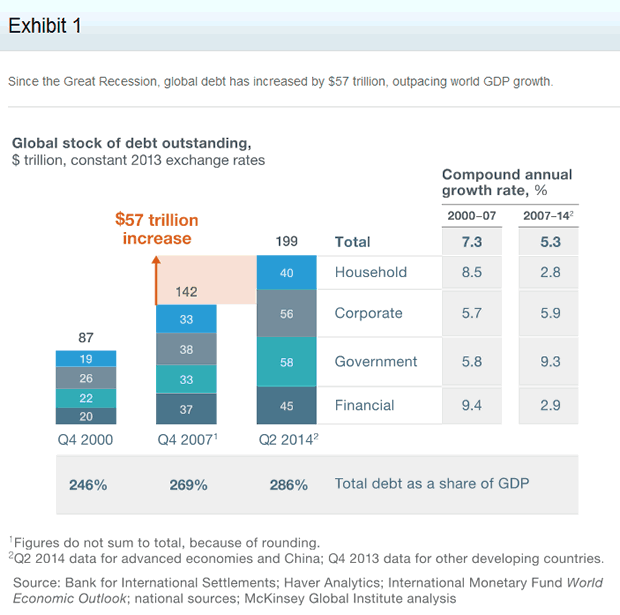

Yet the chart above from McKinsey Global Institute makes it clear that the financial wise men of modern finance only took us deeper into debt, making the entire global structure even more fragile.

So what could happen when we reach the bottom of the next global deflationary bust?

Rather than looking to the same group, drunk on the “eternal” riches of more power from more debt, let’s journey back almost 4,000 years to the Egyptians.

[Relief of Senwosret I, 12th Dynasty, 1961-1917 BC, The Metropolitan Museum of Art]

7 Years of Plenty, 7 Years of Famine

In the Hebrew writings of the Tanakh or Old Testament we find the story of Joseph and his interpretation of a dream by an Egyptian Pharaoh. The book of Genesis describes the dream’s meaning.

“That is the thing which I spoke unto Pharaoh: what God is about to do He hath shown unto Pharaoh. Behold, there come seven years of great plenty throughout all the land of Egypt. And there shall arise after them seven years of famine; and all the plenty shall be forgotten in the land of Egypt; and the famine shall consume the land; and the plenty shall not be known in the land by reason of that famine which followeth; for it shall be very grievous.” – Genesis 41: 28-31, A Hebrew –English Bible

Whereas Joseph’s plan during the 7 years of plenty was for the Pharaoh to appoint overseers to collect 20% of the gain and store it up in the communities across Egypt in anticipation of the coming famine (Gen 41: 34-36), anyone looking at the actions of central bankers and government leaders since the Great Recession in 2008 can easily see that all “the grain” was used up and even more spent, as the public was lead to embrace the idea that the borrower is not the lender’s slave, but the basis of “experiencing” prosperity!

Famine? Pain? You must be joking; debt based money could always be created at a moments notice to overcome such obstacles, and without long term consequences. Right?

With global markets hitting record highs in 2014 and 2015, the real lesson we need to consider today, is what we could learn from the actions of the Egyptians and surrounding people as the famine changed their lives.

1) They first ran out of money to buy back the grain collected by the Pharaoh during the years of plenty.

“There was no food, however, in the whole region because the famine was severe; both Egypt and Canaan wasted away because of the famine. Joseph collected all the money that was to be found in Egypt and Canaan in payment for the grain they were buying, and he brought it to Pharaoh’s palace. When the money of the people of Egypt and Canaan was gone, all Egypt came to Joseph and said, ‘Give us food. Why should we die before your eyes? Our money is all gone.'” – Gen. 47: 13-15, NIV

As this headline from 2008 reminds us, our money today is really credit. When things get tough, credit tightens, meaning there is less available from the banks.

U.S. Banks Tighten Lending Standards, NY Times, January 7, 2008

2) As a solution to this financial crisis during the famine, Joseph established plan #2, and the people sold their livestock, or what we might see today as the businesses of the people.

“’Then bring your livestock,’ said Joseph. ‘I will sell you food in exchange for your livestock, since your money is gone.’ So they brought their livestock to Joseph, and he gave them food in exchange for their horses, their sheep and goats, their cattle and donkeys. And he brought them through that year with food in exchange for all their livestock.” – Gen. 47:16-17, NIV

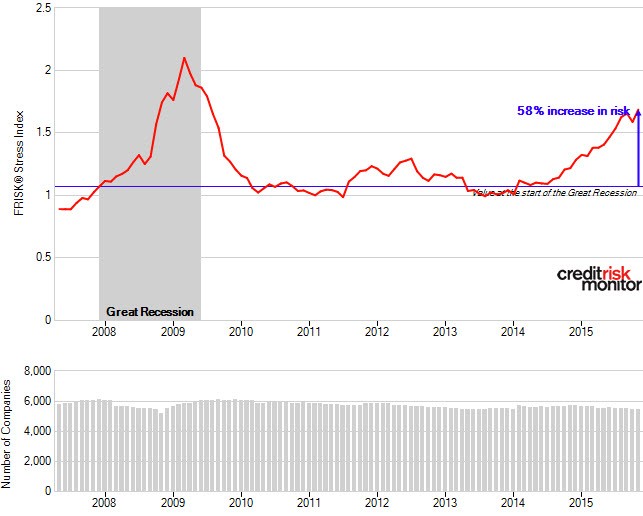

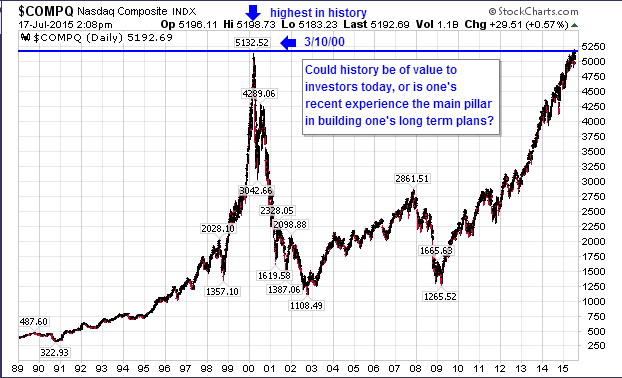

While the Dow and S&P 500 stand at almost the same level they did when arriving here for the 1st time in history last December, giving the impression that American business is healthy, the chart above reflects the fact that the risk from bankruptcy has climbed for 2 years and is already at late 2008 levels (the sampling is based on 10,000 US businesses).

Clearly, the illusion from Wall Street is not reflecting the reality of Main Street. Based on the Wall Street view, we have not even started “the financial famine” yet.

But based on the rising risk of bankruptcies, the state will gain less and less from Main Street businesses in the period ahead. In fact, if more emphasis had been placed on start up and small businesses in the last 7 years, rather than pouring debt into larger global corporations so they could inflate their stock through constant buybacks, the economy would be healthier today. In other words, we would have had more stored up to cushion the severe slowdown that must come from all the money spent on the now even larger debt loads worldwide.

3) When the year was over, the people returned to “the state”, seeking another solution.

“When that year was over, they came to him the following year and said, ‘We cannot hide from our lord the fact that since our money is gone and our livestock belongs to you, there is nothing left for our lord except our bodies and our land. Why should we perish before your eyes—we and our land as well? Buy us and our land in exchange for food, and we with our land will be in bondage to Pharaoh. Give us seed so that we may live and not die, and that the land may not become desolate.’” – Gen. 47:18-19, NIV

4) And another solution to purchase food was found.

“So Joseph bought all the land in Egypt for Pharaoh. The Egyptians, one and all, sold their fields, because the famine was too severe for them. The land became Pharaoh’s, and Joseph reduced the people to servitude, from one end of Egypt to the other.

So Joseph bought all the land in Egypt for Pharaoh. The Egyptians, one and all, sold their fields, because the famine was too severe for them. The land became Pharaoh’s, and Joseph reduced the people to servitude, from one end of Egypt to the other.

Joseph said to the people, ‘Now that I have bought you and your land today for Pharaoh, here is seed for you so you can plant the ground. But when the crop comes in, give a fifth of it to Pharaoh. The other four-fifths you may keep as seed for the fields and as food for yourselves and your households and your children.’” – Gen 47:20-24

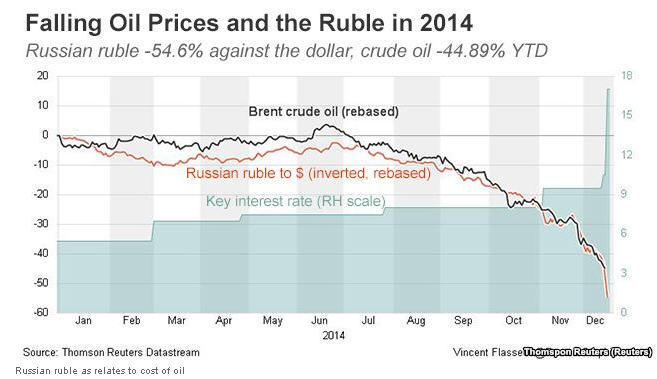

Today, it is impossible for most Americans to consider being in a situation where even buying food would require selling assets and working in servitude to the state just to survive. Yet, whereas the average American spends approximately 6% of their budget today on food, the average Iranian, Indian, and Chinese spends about 25% on food, and the average Russian and Indonesian spends about 33%. For this reason, when their currencies plummet in value against the US dollar or other major currencies, it can place the people of those nations under extreme stress, and working under very harsh conditions are expected as part of surviving in that environment.

The US Spends Less on Food Than Any Other Country In The World, International Business Times, January 23, 2014

Food Prices in Russia Soar As Ruble Tumbles Further, The Moscow Times, Dec 16, 2014

Of course demographic changes like shown in the headline below remind Americans that finding money for some of our most basic needs is becoming more and more difficult.

Record 94,610,000 Americans Not In Labor Force, Breitbart, Oct 2, 2015

One of the most sobering documents I have examined in the 10 years of researching global markets and the global economy, is the US State Department’s annual Trafficking in Persons Report. As the global economy continues to slow from the largest and fastest increase of debt in world history, even more painful stories will follow. Labor conditions are already abominable in various nations around the world today, much like the sons of Israel experienced under the Egyptians a few centuries after Joseph had died. I hate to think how global working conditions could deteriorate even more.

Let’s return to the famine that struck Egypt and Canaan.

At the end of this period of time the people were now in bondage to “the state”. The people had sold everything to “the state” in order to buy food. Because they had food, “the state” had rescued them from the famine.

In Genesis 47:25, the people saw their current juncture as a good thing, much like the public at large has seen deep interest rate cuts and massive bailouts as policies that “returned things to normal”.

“’You have saved our lives,’ they said. ‘May we find favor in the eyes of our lord; we will be in bondage to Pharaoh.'”

The problem, like parts of today’s world, was that people had given up their money, their businesses, their private property, and agreed to work for the state, paying the Pharaoh 20% of what they earned and keeping the remaining 80% for their daily needs.

Happy Ending?

“No one was unhappy in my days, not even in the years of famine, for I had tilled all the fields of the Nome of Mah…thus I prolonged the life of its inhabitants and preserved the food which it produced.” – Ameni, a providential governor under Senwosret I

As anyone knows from reading the book of Genesis and Exodus, the descendants of Jacob (Israel)[Gen 35:10] prospered during the famine while raising their livestock in Goshen [Gen 45:1, 47:6,11, & 27] , land given them by Pharaoh, a few centuries later the Egyptians felt threatened by them, and work conditions for the descendants of Israel became very hard and like slaves.

“Now a new king arose over Egypt, who did not know Joseph. He said to his people, ‘Behold, the people of the sons of Israel are more and mightier than we. Come, let us deal wisely with them, or else they will multiply and in the event of war, they will also join themselves to those who hate us, and fight against us and depart from the land.’ So they appointed taskmasters over them to afflict them with hard labor. And they built for Pharaoh storage cities, Pithom and Raamses…. The Egyptians compelled the sons of Israel to labor rigorously; and they made their lives bitter with hard labor in mortar and bricks and at all kinds of labor in the field, all their labors which they rigorously imposed on them.” – Exodus 1: 8-11, 13-14, NASB

So with today’s financial bubbles starting to burst worldwide since 2014, while the “overseers” of modern finance continue promising even deeper negative interest rates or more intervention into our economic life and markets, we have come to a point in history where the “years of plenty” illusion is quickly running out of steam.

As the financial famine continues setting in, will we turn to answers outside the gods of modern Keynesian finance and unlimited debt solutions of the past? Once everyone knows we are at another major crisis, what will we be willing to sell or pledge to the state in order to stop the pain? As power centralizes at the global level, will we eventually say, “You saved our lives”? At what costs to us and future generations?

One World, One Bank, One Currency, Daily Reckoning, Addison Wiggins, Oct 1, 2014

In Joseph’s time the people came to see the Pharaoh and “the state” as the only solution to their situation. John’s writing in Revelations seems to reveal that the past could have a connection to the future.

“And he causes all, the small and the great, and the rich and the poor, and the free men and the slaves, to be given a mark on their right hand or on their forehead, and he provides that no one will be able to buy or to sell, except the one who has the mark, either the name of the beast or the number of his name.” – Revelations 13:16-17

Since 2008, the powers of central bankers and governments have only grown, thus whether seeking funds from the state through social safety nets or the greatest intervention by central banks into financial markets ever seen, we have already watched the public at large accept that this form of financial socialism has brought things back to “normal”.

However giving over so much power to this small group has reduced our motivation to seek solutions at the individual and local level. The national and global level has become the highest authority in the life of the people. Could this worldwide story be headed into a time of bondage as well?

A Skeptical Mind